Hala

المنتجات

اختر المنتج الذي تود تجربته أولاً

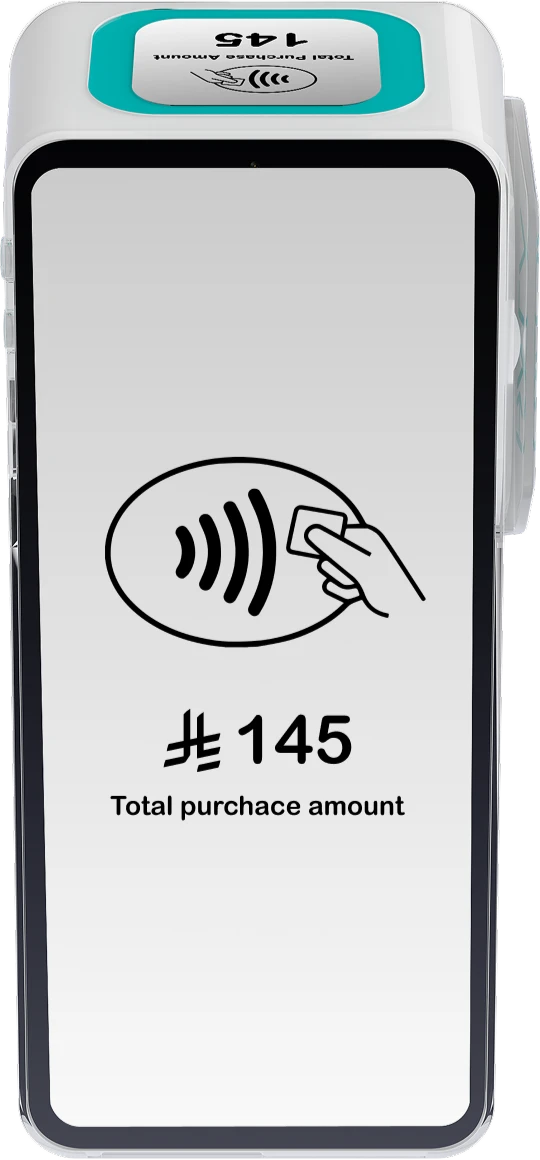

جهاز نقاط البيع

نقاط الدفع الهاتفية

حساب الآيبان للأعمال

نظام نقاط البيع السحابي للمطاعم

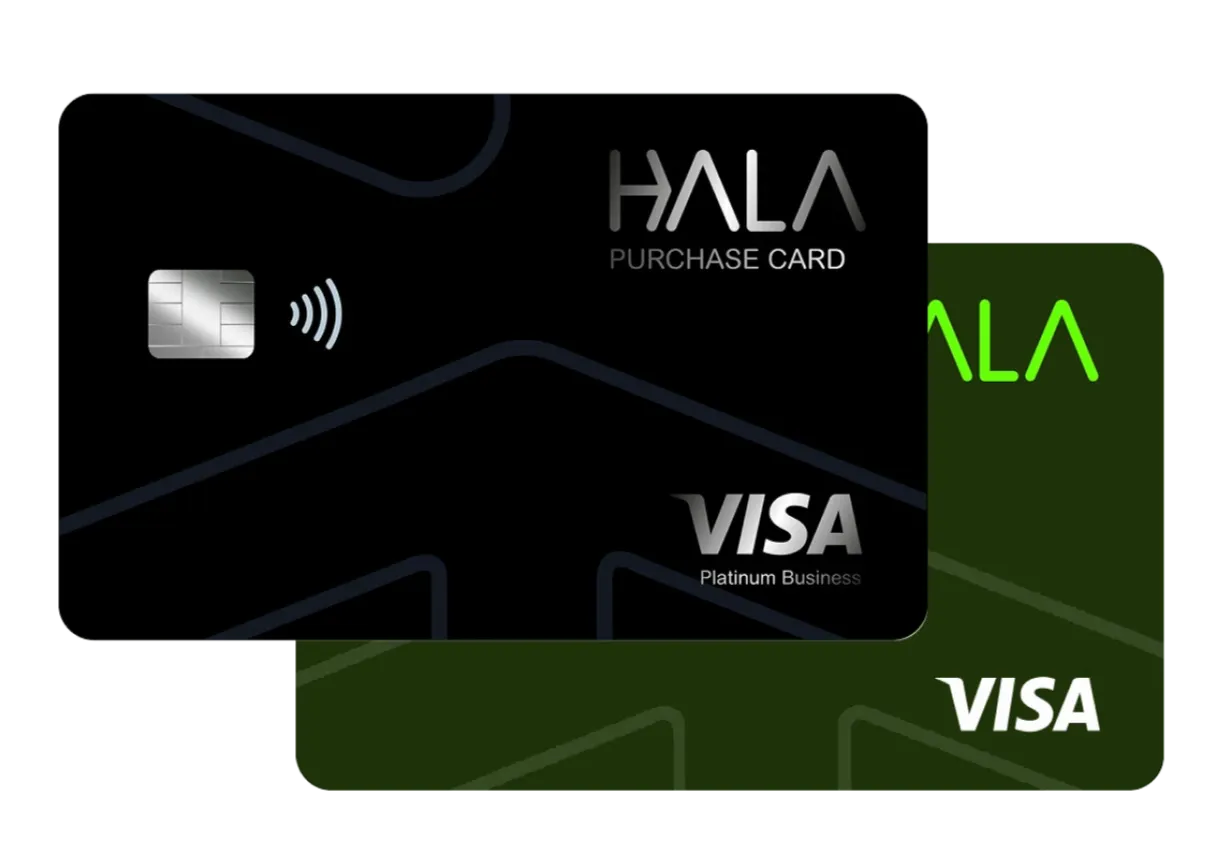

إدارة النفقات

English

حساب متكامل للشركات الناشئة

انضم إلى أكثر من 150,000 شركة صغيرة وصاحب عمل حرّ يستخدمون هلا لقبول المدفوعات وإدارة شؤونهم المالية

اختر المنتج الذي تود تجربته أولاً

جهاز نقاط البيع

نقاط الدفع الهاتفية

حساب الآيبان للأعمال

نظام نقاط البيع السحابي للمطاعم

إدارة النفقات

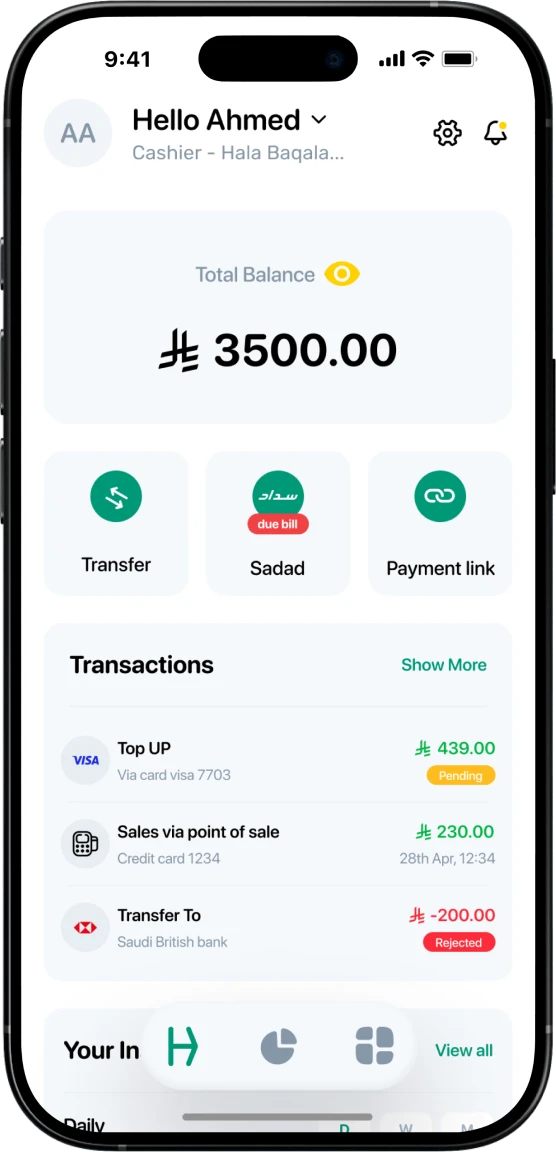

كافة احتياجات عملياتك المالية. منصة واحدة.

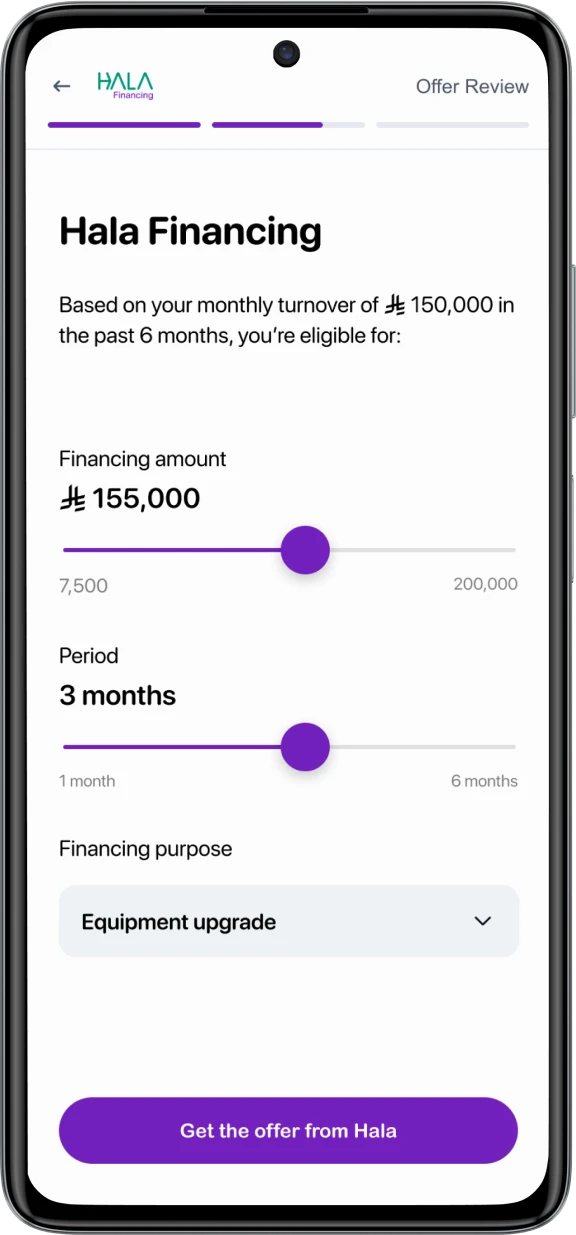

حساب الأعمال الذي يعطيك تسوية فورية للمبيعات إلى حسابك، مع قبول وإرسال المدفوعات والتحكم في المصروفات والحصول على التمويل لتنمية منشأتك، وكلّ ذلك من منصة واحدة.

موثوق من قبل الشركات الصغيرة والمتوسطة

هلا هي الحل البسيط والموثوق لإدارة الشؤون المالية للشركات الصغيرة في المملكة العربية السعودية. من المدفوعات إلى المشتريات والتمويل، نحن نغطي كل شيء.

100,000 شركة صغيرة ومتوسطة

التجار يستخدمون هلا يوميًا

20 مليار

حجم المعاملات المعالجة

مرخصة من البنك المركزي السعودي (ساما)

مؤسسة مالية مرخصة بالكامل في السعودية

هلا هي منصة تقنية مالية رائدة تهتم بتمكين المنشآت الصغيرة والمتوسطة من إدارة إيراداتهم .ومدفوعاتهم بطريقة سهلة وآمنة

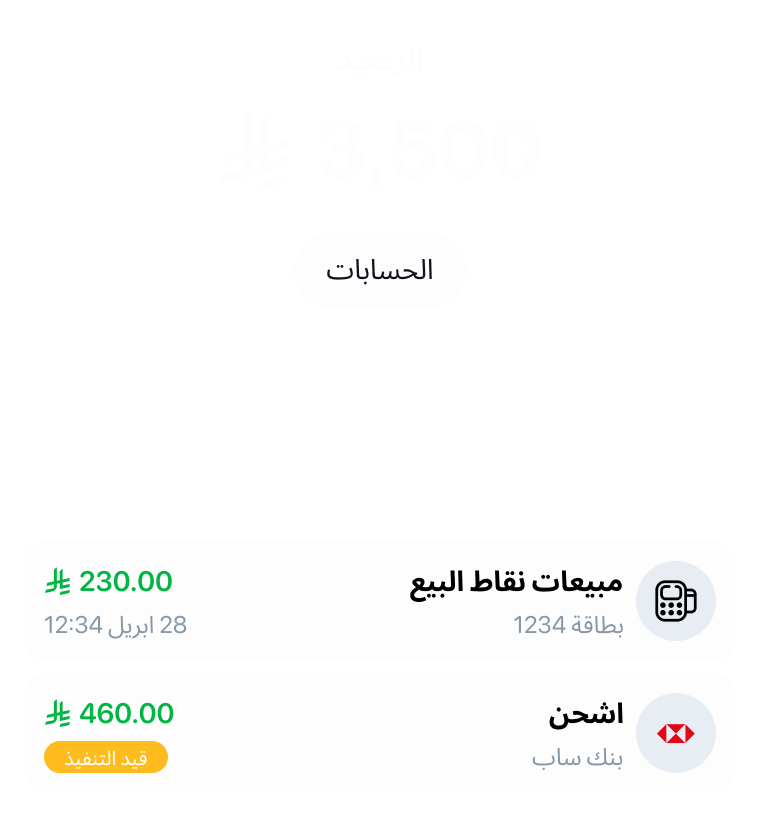

حسابات البنك

الدفع والتحويل

قبول المدفوعات

إدارة الأعمال

خاضعة لإشراف ورقابة البنك المركزي السعودي. شركة هلا للمدفوعات، سجل تجاري رقم 4030548330